Corporate Governance

Basic Approach

The Taisho Pharmaceutical Group (the “ Group”) aims to establish even stronger management foundations to ensure that it fulfills its corporate mission in accordance with its Management Policy and continues to achieve steady growth and development amid global competition.

Guided by this philosophy, Taisho Pharmaceutical Holdings Co., Ltd. (the “Company”) was established as a pure holding company to manage the Group as a whole. The Company is responsible for formulating Group management strategy and effectively allocating resources to businesses and operations in Japan and overseas with the objective of increasing corporate value by generating sustainable, balanced growth and strengthening competitiveness in the Self-Medication Operation Group and Prescription Pharmaceutical Operation Group, and by achieving synergetic effects between these two businesses.

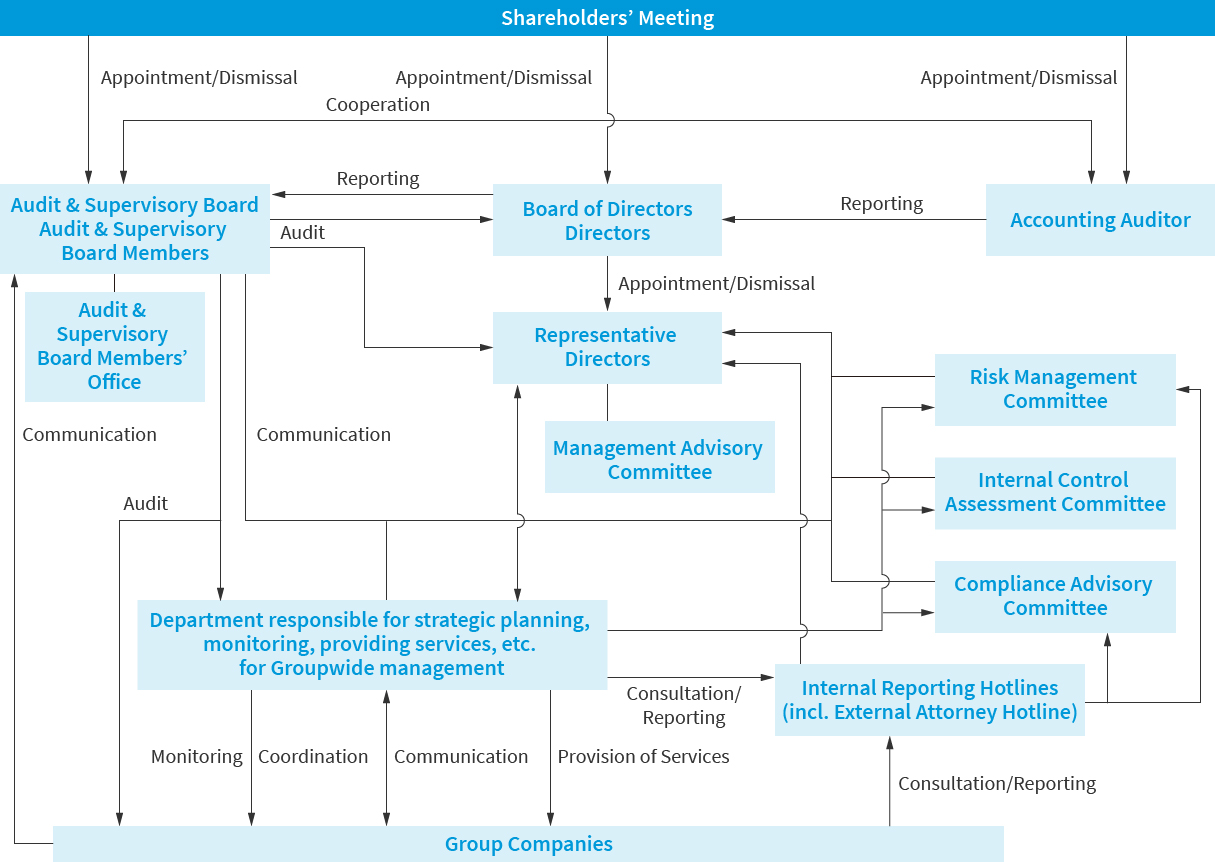

Accordingly, the Company has established an appropriate Groupwide management framework for properly monitoring and supervising the status of business and operational execution at the Company and Group companies. Specifically, the Group establishes a corporate governance structure and properly implements this structure, with the aim of achieving its overall business objectives and fulfilling its social responsibilities. The basic principle behind these efforts is for the Board of Directors and the Audit & Supervisory Board or its members to work in close collaboration, while properly managing the entire Group by exchanging information with the business management bodies of the Company and Group companies.

Corporate Governance Structure

Corporate Governance Structure

The Company has adopted a corporate governance structure with a Board of Directors and an Audit & Supervisory Board. As of July 1, 2024, the Company has three directors, two of whom are outside directors, and four Audit & Supervisory Board members, two of whom are outside members.

Board of Directors

The Board of Directors makes decisions on important matters related to the Company’s business execution and Groupwide management, and monitors operations undertaken based on these decisions. The Management Advisory Committee, whose members include the Company’s representative directors, serves as an advisory body to the Board of Directors. It meets on an as-required basis and deliberates important matters, including matters put forward to the Board of Directors, further facilitating effective and rapid management decision-making. It is configured so as to enable sufficient discussion from diverse standpoints not only of employee attributes such as gender and nationality but also issues that include the Company’s continued development and decision-making on important matters.

Audit & Supervisory Board

The Audit & Supervisory Board meets, in principle, at least once every three months. At these meetings, its members exchange opinions regarding the status of the audits they conduct in accordance with principles and standards for audits that have been established by the Audit & Supervisory Board, and receive reports on the processes and results of audits conducted by the accounting auditor and on internal control system audits. Audit & Supervisory Board members check the status of business execution and asset protection and report as appropriate to the representative directors and the Board of Directors, providing advice as needed.

Other Frameworks

The main divisions of the Company as well as each of the Group companies appropriately communicate management-related information by conducting information meetings with Audit & Supervisory Board members, regarding the status of execution and issues related to the business activities of each company.

The Company has set up various committees comprised primarily of directors in charge of respective businesses and managers from related departments and divisions to address a variety of across-the-board business management issues faced by the Company and Group companies. These committees include the Risk Management Committee, the Compliance Advisory Committee and the Internal Control Assessment Committee. The Company implements Groupwide monitoring of various issues in each field, and has a reporting system in place to ensure that appropriate information is communicated to business managers at the Company and various Group companies.

Outside Directors and Outside Audit & Supervisory Board Members

There are two outside directors and two outside Audit & Supervisory Board members, and there are no personal or capital relationships between the Company and any of the outside directors and outside Audit & Supervisory Board members. The outside directors and outside Audit & Supervisory Board members have been appointed based on their broad experience and specialist knowledge in management, and advanced insight into social responsibility. They are responsible for supervising and auditing the appropriateness of duties from an independent standpoint without direct involvement in the execution of duties.

Outside directors and outside Audit & Supervisory Board members obtain information regarding such matters as compliance, risk management, internal audits, financial reports and evaluation of internal control relating to financial reports from each division in charge of internal control, as well as the results of audits by Audit & Supervisory Board members and the accounting auditor. The information is obtained through the Board of Directors and the Audit & Supervisory Board and is used in various ways to ensure the appropriateness of duties.

Internal Audits and Audits by Audit & Supervisory Board Members

The Audit Division is an organization exclusively for auditing and is independent of the Company’s lines of business execution.This division formulates annual audit plans according to the significance of various risks, based on which it performs internal audits in accordance with the Company’s internal auditing regulations. In addition, it maintains close contact with the audit organizations of Group companies, with a view to overseeing and managing the implementation of internal audits by Group companies. Regarding internal control audits, the Audit Division and the accounting auditor cooperate to enable the appropriate and efficient execution of mutual audit operations by sharing information concerning audit plans, procedures and verification results.

The Audit & Supervisory Board is composed of two full-time members and two outside members. In addition, the Audit & Supervisory Board Members’ Office has a specialized staff to enhance the effectiveness of audits by Audit & Supervisory Board members.

Audit & Supervisory Board Members conduct comprehensive audits of all Director duties in line with audit policies formulated in accordance with audit standards set by the Audit & Supervisory Board. Full-time Audit & Supervisory Board Members attend meetings of the Board of Directors and other important meetings, and routinely audit the decision making of the Board of Directors and Directors and the status of execution of Directors’ duties primarily through field audits of divisions within the Company and offices of Group companies. Full-time Audit & Supervisory Board Members establish regulations for communicating and reporting to Audit & Supervisory Board Members and the Audit & Supervisory Board. They set rules that they must report directly to Audit & Supervisory Board Members if they have obtained information or learn that job duties are not performed appropriately by any of the Directors and employees of the Company and its subsidiaries, who has violated a law, regulation, the Articles of Incorporation, or an important internal rule or caused a compliance problem or related issue, and they must not cause any disadvantage to a whistleblower for making a report while gathering important information on risks.

The Audit & Supervisory Board receives reports on the status of execution of Directors’ duties and the progress and results of audits on accounting and internal control with a focus on legality, risk management and internal control as areas of examination, and reports to the Representative Directors and other Directors on the status and results of audits implemented by the Audit & Supervisory Board Members.

The Audit & Supervisory Board members, the Audit Division and the accounting auditor communicate with each other to support the execution of efficient and effective audits.

Accounting Auditor

The Company has concluded an audit contract with and undergoes audits by Ernst & Young ShinNihon LLC in accordance with the Companies Law.