Our Business

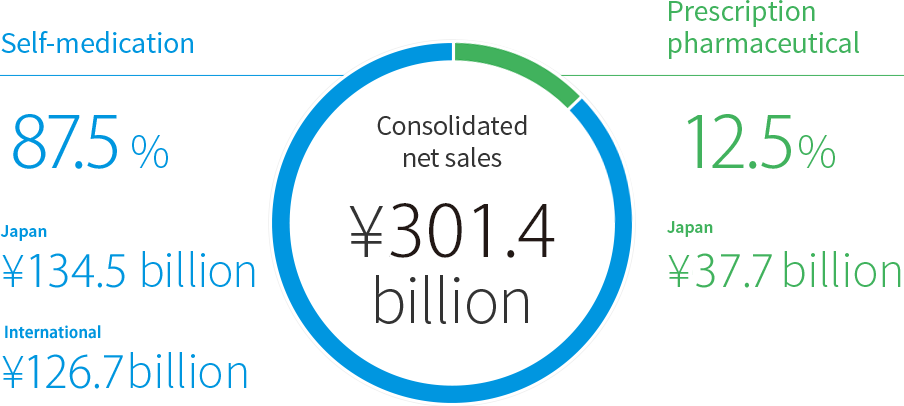

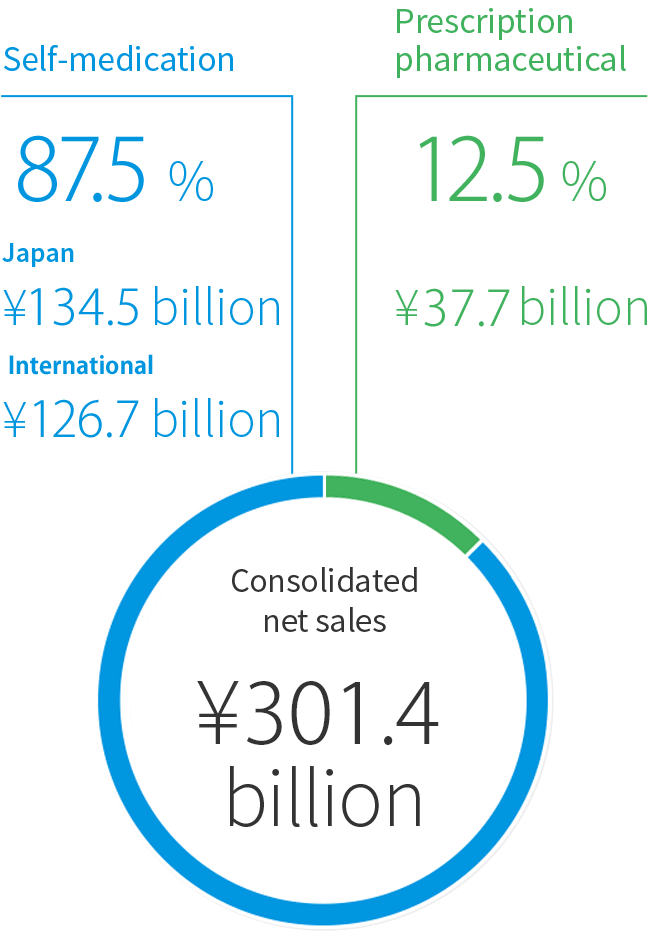

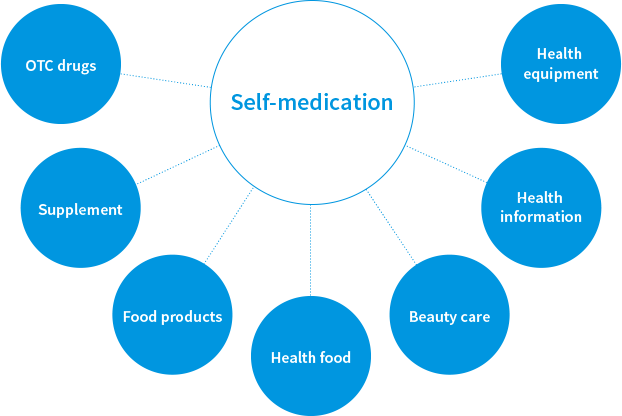

We support health and wellbeing through a comprehensive range of over-the-counter (OTC) treatments and prescription pharmaceuticals. Our product lines cover every aspect of wellness, from prevention to cure. On a corporate level, we aim to combine balanced growth in order to increase the value of the entire Taisho Pharmaceutical Group.

Self-medication operation group

Japan

Business environment

Growing importance of

OTC and lifestyle/beauty products

Successful universal health coverage

Japan’s system of universal health insurance has been a great success. It has achieved life expectancies and healthcare standards that rank among the world’s best. However, maintaining these standards is increasingly costly.

An ongoing shift to OTC products

In 2017, the Japanese government began offering tax deductions for certain OTC purchases. The goal of this “self-medication tax deduction system” is to encourage people to treat minor ailments themselves instead of visiting medical facilities. It may spur new growth in the OTC market.

A growing healthcare market

In Japan as elsewhere, awareness of health issues is rising. People are becoming more active and informed custodians of their own wellbeing. This has led to a growing market for healthcare in general.

Strengths and strategies

Bringing a century of experience and

knowledge to new business domains

Firm corporate foundations

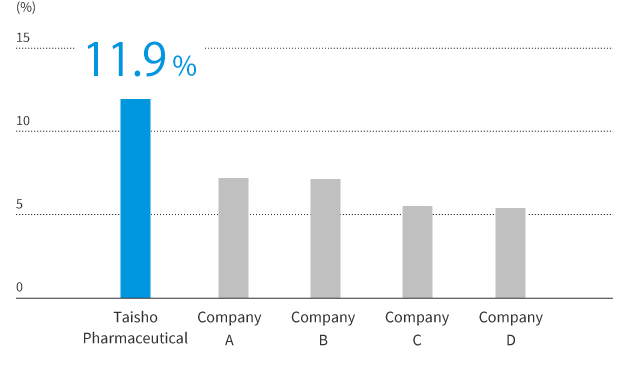

The Taisho Pharmaceutical Group enjoys the largest single share of Japan’s OTC drug market. Several of our brands lead in their category, including the well-known Lipovitan and RiUP series.

Top share in Japan’s OTC market

Expanding into new domains

As well as our web store, which has offered direct consumer sales since 2006, we continue to expand into new domains such as beauty products and health food. We are growing our existing brands and developing new ones to meet the needs of today’s consumers.

Research and development

Bolstering our product lineup in growth areas

Consumer-centric R&D

Our research into OTC products maintains a consumer-centric viewpoint. We focus on three key issues: safety, efficacy, and convenience. As a result, our research topics range from specialized medical matters, such as OTC uses for ingredients proven effective in prescription pharmaceuticals, to technology for hiding bitter tastes and unpleasant smells.

Worldwide

Strengths and strategies

Continued growth

through strategic M&As of local brands

Fifty years of experience

We have successfully sold products outside Japan for over half a century. Beginning with energy drink exports to Taiwan in 1963, our international operations now extend across Asia and to Europe and the Americas. In particular, we have had a full-fledged presence in the Asian OTC drug market since 2009.

Strategic mergers and acquisitions

In recent years, we have employed strategic mergers and acquisitions to grow our business. In 2019, we joined forces with UPSA, giving us new access to French and other European markets with the backing of more than 80 years of history and consumer confidence.

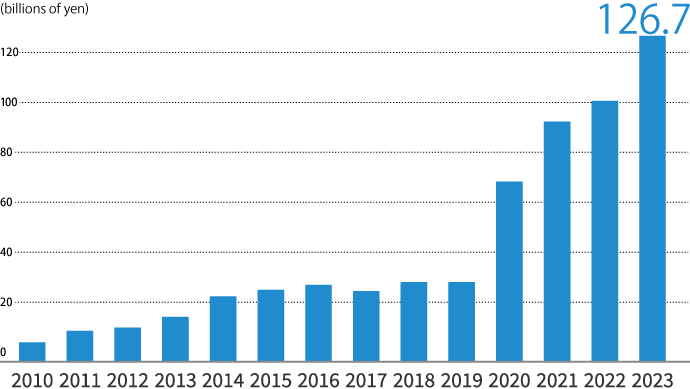

International sales (years ended March 31)

History of international development

- 2009

-

Acquired shares in BMSI

- 2011

-

Acquired shares in Hoepharma Holdings

Acquired Bonamine® and Dramamine® brands from Johnson & Johnson

- 2012

-

Established Osotspa Taisho Pharmaceutical

- 2014

-

Acquired Flanax® brand from Roche

- 2016

-

Commenced capital and business alliance with DHG

- 2019

-

Made UPSA a consolidated subsidiary

-

Made DHG a consolidated subsidiary

Prescription pharmaceutical operation group

Business environment

Pressing need for new drug development

Market growth and pricing pressures

Japan’s “super-aging” population is driving growth in the prescription pharmaceutical market. At the same time, it is also placing increasing stress on the country’s universal health coverage system, not least in financial terms.

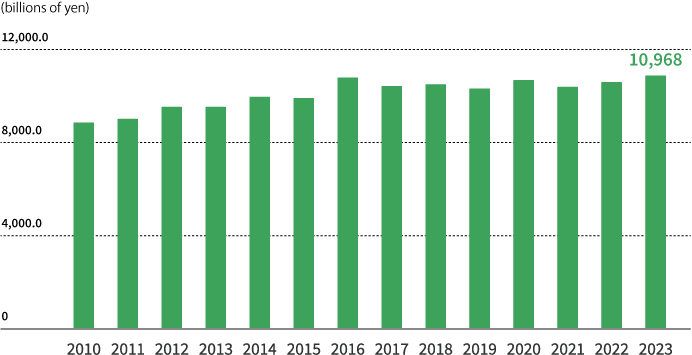

Japan’s prescription drug market (fiscal years ended March 31)

Copyright© 2022 IQVIA.

Source: Calculated based on JPM Apr. 2010—Mar. 2023, MAT, Reprinted with permission.

Reexamining the cost of care

Japan’s medical sector is taking a multi-pronged approach to ensuring that the country’s healthcare system remains sustainable. Medical professionals are prescribing more generic medications, supported by initiatives to raise awareness of and support for generics. Regulators are also reviewing pharmaceutical pricing more closely.

Strengths and strategies

Creating new drugs as an R&D-oriented pharmaceutical company

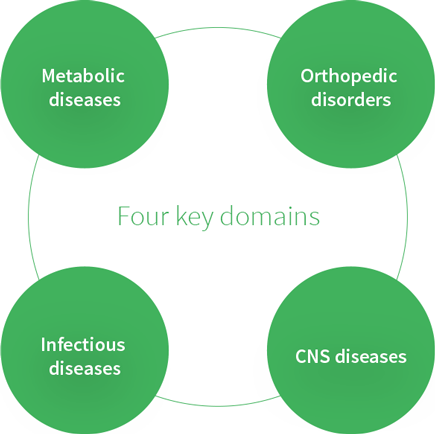

Four key domains for prescription drug development

Our Prescription Pharmaceutical Operation Group focuses on four key domains: metabolic diseases, orthopedic disorders, infectious diseases, and CNS diseases. Successful products developed in-house include the macrolide antibiotic Clarith (released in 1991) and the type 2 diabetes mellitus agent Lusefi (released in 2014).

Research and development

Meeting a wide range of needs from

the customer’s standpoint

Reinvesting revenue in R&D

We reinvest a significant portion of our revenue in cultivating new knowledge and capabilities. Our R&D budget is around 8% of net sales. This allows us to remain at the forefront of research and address the needs of today’s patients.

A collaborative approach

Our global R&D base is our Omiya Research Center. Here we develop our own new treatments as well as investigating promising new discoveries from other companies and research institutes around the world, often in concert with the original research team.

Widening the pipeline

Our collaborative R&D process widens the pipeline for new products, and we maintain a constant flow of products moving toward release both in Japan and overseas. This medium- to long-term outlook gives our business stability and helps us craft global strategy.

Development pipeline (As of February 13, 2024)

| Name | Formulation | Development | Planned indication | Phase | |||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | |||||

| Japan | TS-071* |  |

In-house | Type2 diabetes (Pediatric) |  |

||

| TS-142 |  |

In-house | Insomnia |  |

|||

| TS-172 |  |

In-house | Hyperphosphatemia |  |

|||

| Overseas | TS-161 |  |

In-house | Depression |  |

||

| TS-134 |  |

In-house | Schizophrenia |  |

|||

| TS-142 |  |

In-house | Insomnia |  |

|||

*TS-071: Generic name “Luseogliflozin Hydrate”

- Oral